Alphaliner: Tanjung Pelepas tops global port throughput growth in H1

World Cargo News

View Source  Tanjung Pelepas leads global port year-on-year volume growth in H1 2025 as PTP handles record volumes for the Gemini Cooperation network.

Tanjung Pelepas leads global port year-on-year volume growth in H1 2025 as PTP handles record volumes for the Gemini Cooperation network.

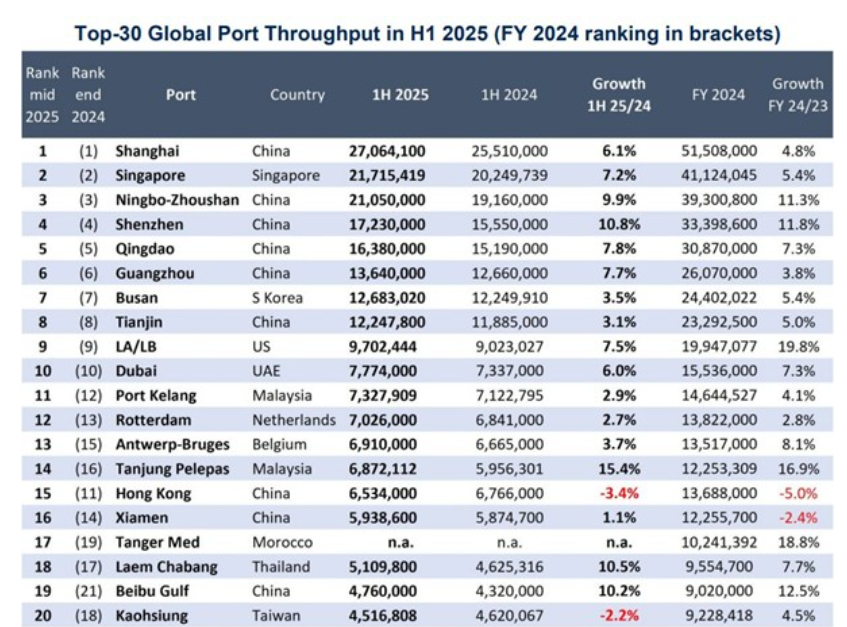

Malaysia’s Tanjung Pelepas recorded the largest year-on-year increase among the world’s top container ports, according to Alphaliner’s mid-year review of the top-30 ports. Terminal operator PTP, a joint venture between MMC Corp and Maersk’s APM Terminals, reported a 15.4% rise in volumes for the first half of 2025 compared with the same period a year earlier. Throughput for H1 2025 stood at 6.87 m TEU, up from 5.95 m TEU in H1 2024. The surge has been attributed to Gemini Cooperation’s decision to make the port its hub for the headhaul leg of Far East–Europe services, with CEO Mark Hardiman saying Gemini volumes now account for around 60% of total throughput.

PTP handles more calls than any other port in the system, and since the network’s launch, increased volumes have kept PTP’s monthly throughput at record highs. PTP has been boosting capacity to handle the surge in volumes and most recently welcomed several deliveries of advanced equipment. This includes nine electric RTG (e-RTG) cranes, the first four of a 48-unit order placed with Japan’s Mitsui Engineering & Shipbuilding in November 2023, and three STS cranes from SANY Marine. These are the first cranes to be delivered of the 15 STS units on order from SANY and ZPMC.

Top performers

Among other top performers, China’s Shenzhen reported 10.8% year-on-year growth, reaching 17.2m TEU, while Thailand’s Laem Chabang posted 10.5% growth to 5.1m TEU in H1 2025. In terms of overall volumes, Shanghai retains the top spot with 27m TEU, followed by Singapore with 21.7m TEU and Ningbo-Zhoushan close behind at 21.05m TEU. Hong Kong and Kaohsiung were among the few ports to post declines, with Hong Kong down 3.4% year-on-year to 6.5m TEU and Kaohsiung falling 2.2% to 4.5m TEU.

Data from Alphaliner further shows that Malaysia’s second-largest gateway, Port Kelang, recorded 2.9% growth. After several years of decline, Europe’s third-largest port, Hamburg, rose 9.3%, driven by Far East (+10.7%) and Baltic Sea (+20.8%) trade.

US West Coast gateways also saw a rebound as congestion eased. Los Angeles and Long Beach (LA/LB) throughput rose 7.5% in H1 2025 to 9.7m TEU, the highest January–June figure since 2022. By contrast, New York and New Jersey (NY/NJ) grew 4.9% to 4.4m TEU, with LA/LB continuing to outperform in July as shippers rushed imports ahead of tariff changes